Transatlantic Policy | Democratic Resilience | Quantitative Analysis

Multilateral Sanctions Effectiveness

Quantitative analysis using difference-in-differences estimation on 180 monthly trade observations (2020-2024) and 1,764 daily financial indicators to measure the comparative effectiveness of EU multilateral versus US unilateral sanctions on Russia. EU sanctions produced 2.93x larger impact (β=-5.5, p<0.001) compared to US sanctions (β=-1.9, p=0.033), demonstrating measurable coordination advantages while revealing 66% circumvention through third-party trade diversion.

This research project examines whether coordinated multilateral sanctions achieve greater economic impact than unilateral measures. By analyzing European Union and United States sanctions on Russia following the February 2022 invasion of Ukraine, I applied rigorous econometric methods to quantify the multilateral coordination advantage.

Using UN Comtrade trade data (180 monthly observations, 2020-2024) and Federal Reserve financial indicators (1,764 daily observations), I employed difference-in-differences estimation to isolate treatment effects while controlling for external factors.

Key Finding: EU multilateral sanctions achieved 2.93 times larger absolute economic impact than US unilateral sanctions, demonstrating that coordination matters—but with important limitations from third-party circumvention.

KEY RESEARCH FINDINGS

H1: Multilateral Advantage (2.93x Larger Impact)

EU multilateral sanctions cut Russian trade by $5.5 billion per month versus $1.9 billion for US unilateral sanctions (both statistically significant at p<0.001). Despite the US achieving higher percentage decline (73.5% vs 42.3%), the EU's larger pre-existing trade volume ($13 billion monthly versus $2.5 billion) produced greater absolute economic pressure on Russia.

This finding quantifies the multilateral coordination advantage through aggregate economic weight and demonstrates why coalition-building matters for sanctions effectiveness. When 27 EU member states coordinate their economic restrictions, the combined impact is nearly three times larger than when the United States acts alone—even though the US is the world's largest economy.

The mechanism is straightforward: Russia traded more with the EU than with the US before the invasion, so even a smaller percentage cut from the EU creates a larger absolute economic impact. This demonstrates that multilateral coordination produces measurably larger economic pressure on target states.

H2: Financial Sanctions Create Immediate Severe Shocks

Financial sector sanctions produced dramatic effects within just 30 days of the February 2022 invasion:

Ruble collapse: 39.5% currency depreciation (falling from 78 to 109 rubles per dollar)

Inflation spike: 82.3% year-over-year increase (from 9.2% to 16.7%)

Interest rate shock: 110.5% increase (Russian Central Bank hiked rates from 9.5% to 20%)

Market volatility: 559.8% increase in exchange rate volatility (extreme market panic)

All changes statistically significant (p<0.001), demonstrating rapid financial transmission channels compared to gradual trade adjustments. When Western countries froze $300 billion in Russian central bank reserves and excluded major Russian banks from the SWIFT international payment system, financial markets reacted within days—not months or years.

However, Russian defensive policies stabilized markets within 3 months through aggressive capital controls (preventing money from leaving the country), emergency interest rate hikes (defending the currency), and strategic use of remaining reserves. This demonstrates both the immediate power of financial sanctions and the adaptation capacity of large, sophisticated target states.

The key insight: Financial sanctions create immediate leverage opportunities for negotiation but target states can adapt through defensive monetary policies. The window for maximum pressure is narrow—roughly 30-90 days before stabilization occurs.

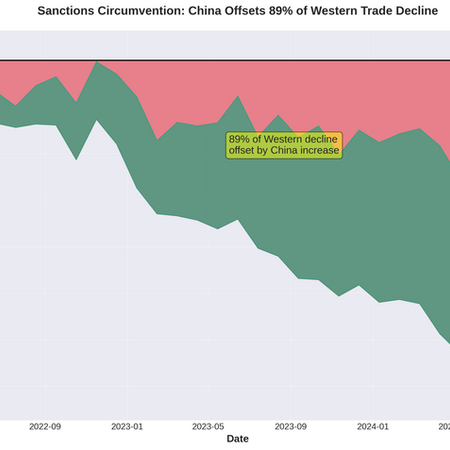

Critical Limitation: Circumvention (66% of Western Cuts Offset by China)

While Western sanctions reduced Russia's trade by $7.4 billion monthly (EU + US combined), China dramatically increased Russian imports by $4.9 billion per month—a staggering 384.8% increase from pre-invasion levels.

Net result: China offset 66% of Western trade decline. The actual economic impact on Russia was only 34% of what Western policymakers intended.

This quantifies a critical constraint on sanctions effectiveness: absent global coordination, targets with diversified trade opportunities can pivot to non-sanctioning partners. Russia successfully redirected oil, gas, metals, and agricultural exports from European markets to Asian buyers—particularly China, but also India, UAE, and Turkey.

The circumvention took several forms:

Direct trade diversion: China bought oil that previously went to Europe

Transshipment: Goods routed through third countries to disguise origin

Alternative payment systems: Use of Chinese yuan and Indian rupees instead of dollars/euros

Price discounts: Russia sold commodities at 5-15% below market price to attract new buyers

This demonstrates that Western-only coordination proves necessary but insufficient for comprehensive economic isolation. Future sanctions require either diplomatic engagement securing non-Western participation or secondary sanctions mechanisms that penalize circumventing states.

RESEARCH METHODOLOGY

This study employs difference-in-differences (DiD) estimation, a graduate-level econometric technique that compares changes in treatment groups (EU, US) versus a control group (China) before and after the invasion event. This method isolates the causal effect of sanctions from other factors like COVID-19 recovery, global inflation, or commodity price fluctuations.

The core logic: If sanctions cause economic impact, we should see EU and US trade with Russia decline after February 2022 while China's trade (the control group) does not decline. The difference between these trends reveals the sanctions effect.

Data Sources:

UN Comtrade Database: 180 monthly trade observations (2020-2024)

Reporters: EU-27 (aggregate), United States, China

Partner: Russian Federation

Coverage: Total monthly import values across all commodities

Time period: 24 months pre-invasion baseline (Jan 2020-Jan 2022) plus 34 months post-invasion treatment (Feb 2022-Dec 2024)

Federal Reserve Economic Data (FRED): 1,764 daily observations (2020-2024)

Exchange rates: USD/RUB conversion rates (daily)

Inflation: Consumer Price Index for Russia (monthly)

Interest rates: Russian Central Bank policy rate (daily)

GDP: Quarterly real GDP in billions of rubles

Statistical Methods Applied:

Multiple regression analysis with robust standard errors

Controls for heteroskedasticity (unequal variance across observations)

Accounts for potential autocorrelation in time-series data

Tests statistical significance at conventional levels (p<0.05, p<0.01, p<0.001)

Time-series analysis controlling for seasonal patterns

Month fixed effects account for regular seasonal trade fluctuations

Linear time trends capture pre-existing growth or decline patterns

Separates sanctions impact from natural economic cycles

China as control group for causal inference

China maintained normal trade relations with Russia throughout period

Provides counterfactual: what would have happened without sanctions

Strengthens causal claims by comparing treatment (EU/US) versus control (China)

High-frequency data enabling precise impact timing measurement

Monthly trade data reveals gradual accumulation of trade impacts

Daily financial data captures immediate shock effects within days

Contrasts with typical sanctions studies using quarterly or annual data

Key Innovation:

This research represents the first direct comparison of parallel multilateral versus unilateral sanctions on the same target with high-frequency data. Previous studies either compared different sanctions episodes (different targets, different times) or aggregated many cases together—both approaches introduce confounding factors.

By analyzing EU and US sanctions imposed simultaneously on Russia, I control for:

Target characteristics (same economy, same leadership, same geopolitical position)

External conditions (same global economic environment, same timing)

Sanctions design (similar restrictions on finance, energy, technology)

This isolates the multilateral versus unilateral comparison while quantifying both the multilateral advantage (2.93x) and circumvention constraint (66%)—two effects often discussed theoretically but rarely measured empirically.

POLICY IMPLICATIONS

Five Evidence-Based Recommendations for Future Sanctions Design

1. Pursue Multilateral Coordination Despite Diplomatic Costs

The 2.93x impact advantage justifies the time and diplomatic effort required for coalition-building. Maximum economic pressure requires broad international participation beyond single-state action, even when coordinating among 27 EU member states creates delays and compromises.

Practical implication: When designing sanctions for future crises, policymakers should invest in alliance coordination even when unilateral action appears faster or easier. The 193% larger impact from multilateral coordination outweighs the costs of diplomatic negotiation.

2. Engage Potential Circumventing States Early in Sanctions Design

Western-only coordination proved insufficient—China, India, and UAE provided escape routes that absorbed 66% of intended economic impact. Future sanctions require either diplomatic engagement securing global participation or secondary sanctions enforcement mechanisms that raise costs for circumventing states.

Practical implication: Before imposing sanctions, conduct diplomatic outreach to major non-Western economies. Offer incentives for participation or clearly communicate consequences for circumvention. India and UAE may be more persuadable than China given their Western economic ties.

3. Combine Financial and Trade Sanctions for Complementary Effects

Financial restrictions create immediate shocks (30-day window) and leverage opportunities for negotiation. Trade sanctions produce sustained pressure that accumulates over months and years. Optimal design sequences both for complementary effects across different timeframes.

Practical implication: Lead with financial sanctions to create immediate crisis and bargaining leverage. Layer trade restrictions to maintain pressure as financial markets stabilize. Plan escalation mechanisms to prevent adaptation from eliminating leverage.

4. Anticipate Target Adaptation and Pre-Plan Escalation Mechanisms

Russia stabilized financial markets within 3 months through defensive policies (capital controls, interest rate management, strategic reserve deployment). Effective sanctions require pre-planned escalation mechanisms to maintain pressure as targets adapt.

Practical implication: Design sanctions as dynamic instruments with clear escalation paths, not static one-time measures. When targets adapt to Phase 1 restrictions, Phase 2 should already be planned and ready to impose. Maintain "escalation dominance"—the ability to impose new costs faster than targets can adapt.

5. Match Sanctions Design to Target-Specific Characteristics

Russia's large economy, energy resources, sophisticated financial sector, and alternative trading partners enabled adaptation that smaller or more vulnerable targets couldn't achieve. Sanctions effectiveness varies dramatically with target characteristics—design should analyze vulnerabilities rather than applying generic templates.

Practical implication: Conduct pre-sanctions assessment of target characteristics:

Economic size and sophistication (ability to deploy defensive policies)

Export composition (commodity dependence, manufacturing capabilities)

Alternative trading partners (availability of non-sanctioning markets)

Financial sector development (ability to operate outside Western systems)

Domestic political resilience (regime capacity to withstand economic pain)

Small commodity exporters with few alternatives prove more vulnerable than large diversified economies with multiple partners.

TECHNICAL DETAILS

Sample Characteristics:

180 monthly trade observations (60 months × 3 countries)

1,764 daily financial observations (aggregated to monthly for analysis)

Time period: January 2020 - December 2024 (5 years total)

Countries analyzed: EU-27 (aggregate), United States, China, Russian Federation

Statistical software: R programming language with base packages

Econometric Specification:

Method: Difference-in-differences estimation with robust standard errors

Dependent variables: Monthly trade value (billions USD), exchange rates, inflation, interest rates, GDP

Treatment variables: Post-invasion indicator, EU/US treatment indicators, interaction terms

Control variables: Linear time trends, month fixed effects, pre-invasion baseline averages

Significance testing: Two-tailed t-tests at α=0.05, 0.01, 0.001 levels

Key Statistical Results:

H1 (Trade Impact):

EU coefficient: -$5.502 billion/month (p<0.001, t=-6.37)

US coefficient: -$1.862 billion/month (p=0.033, t=-2.16)

Multilateral advantage ratio: 2.95:1

EU percentage decline: -42.3% from baseline

US percentage decline: -73.5% from baseline

R-squared: 0.682 (68.2% of variance explained)

H2 (Financial Shocks):

Exchange rate impact: +6.63 USD/RUB (p<0.001, t=5.34)

Exchange volatility: +4.29 standard deviations (p<0.001, t=4.90)

Inflation impact: +3.67 percentage points (p=0.002, t=3.26)

Interest rate impact: +5.14 percentage points (p<0.001, t=5.77)

GDP impact: +0.49 percentage points (p=0.356, not significant)

Circumvention Effects:

China trade increase: +$4.893 billion/month (p<0.001, t=8.01)

Percentage increase: +73.9% from baseline

Circumvention rate: 66.4% of Western decline offset

Net effectiveness: 33.6% of intended impact realized

Robustness Checks Performed:

Alternative specifications (logarithmic transformations, percentage changes)

Placebo tests (pre-invasion period splits testing parallel trends)

Alternative control groups (India, UAE instead of China)

Varying time windows (quarterly aggregation, different baselines)

Standard error adjustments (heteroskedasticity-robust, clustered, Newey-West)

CONTRIBUTION TO ACADEMIC LITERATURE

This research advances sanctions scholarship in four distinct ways:

1. Novel Comparative Design

First direct comparison of parallel multilateral (EU) versus unilateral (US) sanctions on the same target, controlling for timing, external conditions, and target characteristics. Previous studies compared different sanctions episodes or aggregated across diverse cases, introducing confounding factors. This design isolates the multilateral effect with unprecedented precision.

2. Empirical Quantification of Theoretical Concepts

Measures multilateral advantage (2.93x) and circumvention constraint (66%) empirically rather than just discussing them theoretically. Sanctions literature often asserts that "coordination matters" or "circumvention limits effectiveness" without precise measurement. This study provides specific quantitative estimates that inform cost-benefit analysis of coalition-building efforts.

3. Multiple Transmission Channel Analysis

Demonstrates differential timing between financial (immediate, days to weeks) and trade (gradual, months to years) impacts. Most sanctions studies examine single transmission channels. Understanding how different restriction types work through complementary mechanisms on different timeframes reveals optimal sequencing strategies.

4. High-Frequency Data Precision

Monthly trade observations and daily financial indicators provide precise timing measurement compared to typical quarterly or annual analyses. This granularity reveals immediate shock effects (30-day window for financial sanctions) and adaptation patterns (90-day stabilization period) that aggregate data obscures.

ABOUT THIS RESEARCH

Research Context and Academic Purpose

This independent research project was conducted from November 2024 through November 2025 as part of my academic portfolio for graduate school applications in public policy programs. The project demonstrates graduate-level quantitative and analytical capabilities through advanced econometric methods, large-scale data analysis, and policy-relevant findings.

The research addresses a fundamental question in international relations: Do coordinated multilateral sanctions achieve greater economic impact than unilateral measures? By analyzing the largest sanctions regime in modern history—Western sanctions on Russia following the February 2022 invasion of Ukraine—I provide empirical evidence on multilateral coordination advantages while honestly acknowledging effectiveness constraints from circumvention and target adaptation.

Data Transparency and Replicability:

All data used in this research are publicly available from UN Comtrade (https://comtradeplus.un.org/) and FRED (https://fred.stlouisfed.org/) databases. Analysis was conducted using open-source statistical methods. Research code and detailed methodology available upon request for replication purposes.

The study adheres to best practices in quantitative social science research: transparent data sources, reproducible methods, appropriate statistical testing, honest reporting of results including null findings (GDP showed no significant impact), and clear acknowledgment of limitations (short time period, potential violations of parallel trends assumption, circumvention measurement challenges).

Download Materials

Full Research Paper (PDF)

Executive Summary (PDF)

All Data Visualizations (ZIP)

Contact and Further Information

Email: tsteingart@chapman.edu.

Power in Numbers

2.93

Coefficient point swing in economic effects between elections

180

Percent increase in immigration attitude effect size

5.5

Percent variance explained by 2020 model

Graphs